Community Risk & Solution Highlights

36-Month Hazard Outlook

Current Risk Levels

0 = no risk, 10 = extreme risk

Remodeling Solutions

Insurance Discounts

60%

Estimated Savings

Financial Assistance

Utility, State & Local

Table of Contents

Report Overview

Future Proof Community-Level Reports are a comprehensive ranking of current and future extreme weather risks to consider in your area. This information will empower you with a set of recommendations to protect yourself, loved ones, and your property [investment].

Based on your property’s postal code risk calculations which incorporate local disaster factors along with surrounding conditions such as neighboring properties, daily climate (humidity, wind, proximity to water), fire protection, and community support services that influence survivability during extreme weather.

Remediation suggestions from Magic Window® address community-level risk reduction. For property-specific construction plans, budgets, and specifications, subscribers can use the upcoming Future Proof – XHome Survey™ application for tailored remodeling recommendations, including the materials and construction methods required for your unique property.

What’s inside and Why

In the next decade, $1.47 trillion of home value in the United States could vanish as expanding extreme weather dangers are predicted to impact as many as 48 million properties (43.7 % of homes] and 120 million people (35.2% of the population]. With insurance safety nets failing and government programs withdrawn, communities are left unprotected.

With an accelerating rate of extreme weather disasters, this report gives you recommendations to be better prepared:

- 36 month+ risk outlook for your area

- General recommendations for each hazard in your community area

- Mitigate damages you could incur in a weather event

- Remodeling options and rough costs in your area

- Ways to qualify for insurance discounts and/or keep your insurance

- Funding sources to help pay for remodeling

- Return on your investment (ROI) calculations

- And more useful information

Selected Hazards Addressed

- Wildfire—fire-resistant materials, defensible space.

- Flood—elevation, home barriers, drainage.

- Tornado—reinforced safe rooms, wind-rated construction and modifications.

- Hurricane—impact-resistant windows, roof tie-downs.

- Drought—water generation, storage, xeriscaping.

- Heat—reflective roofing, ventilation upgrades.

- Seismic—structural bracing, foundation reinforcement.

- Precipitation—enhanced roofing, sealing, runoff control.

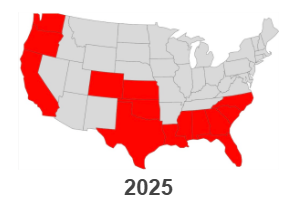

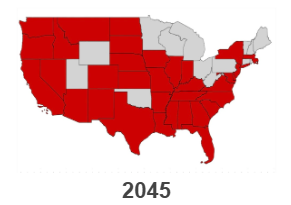

Extreme Weather Risk Trends

Environmental hazards in your region are evolving with impacts that require both immediate attention and long-term planning. Homeowners, planners, and investors should consider this perspective when setting your priorities today and preparing for future adaptation. In the chart below, view trends in your area of extreme weather risk changes for specific hazards today, in three years, and in 25 years.

| Hazard | Today | In 3 Years | In 25 Years | Projected Trend |

|---|---|---|---|---|

| Flood | Very High | Very High | Very High | ↔ Persistent |

| Wind | High | Very High | Very High | ⬆ Risk |

| Drought | Low | Low | Low | ↔ Persistent |

Overview

Over the next three years, the risk evolution for this location is as follows:

- Today: Flood risk is very high, wind risk is high, and drought risk is low.

- Next 3 Years: Flood risk remains very high, wind risk increases to very high, and drought risk remains low.

- In 25 Years: Flood risk remains very high, wind risk remains very high, and drought risk remains low.

These projections indicate a persistent flood risk and an increasing wind risk over the next three years, with no significant change in drought risk.

Highlighted Extreme Weather

Here is an assessment of the environmental hazards for the property at 3911 Majestic Street, Houston, Texas:

| Hazard | Risk Level (Today) | Risk Level (Next 36 Months) | 3-Year Change | Potential Consequences | Potential Avoided Loss |

|---|---|---|---|---|---|

| Flood | Very High | Very High | ↔ Persistent | - Structural damage to buildings - Loss of personal property - Displacement of residents |

$50,000 - $200,000 |

| Wind | High | High | ↔ Persistent | - Roof damage - Broken windows - Downed trees and power lines |

$10,000 - $50,000 |

| Drought | Low | Low | ↔ Persistent | - Reduced water supply - Agricultural losses - Increased fire risk |

$5,000 - $20,000 |

| Wildfire | Very Low | Very Low | ↔ Persistent | - Property damage - Smoke inhalation - Loss of vegetation |

$1,000 - $5,000 |

| Earthquake | Very Low | Very Low | ↔ Persistent | - Structural damage - Ground shaking - Potential for landslides |

$2,000 - $10,000 |

Houston's flood risk remains a significant concern, with the property situated in a very high-risk zone. Recent studies indicate that over 5 million residents in Texas live or work in flood-prone areas, highlighting the widespread nature of this issue. (apnews.com) It's crucial to implement flood mitigation measures and consider comprehensive insurance coverage to protect against potential losses.

Local Hazard History (Past 30 Years)

2024: On May 16, a derecho struck the Gulf Coast, causing widespread damage in Houston and surrounding areas. The storm produced winds up to 100 mph and resulted in at least seven fatalities. (en.wikipedia.org)

2023: On January 24, an EF-3 tornado impacted Harris County, causing significant damage along its 23.66-mile path. The tornado led to injuries and extensive property damage. (en.wikipedia.org)

2017: In August, Hurricane Harvey made landfall, bringing catastrophic flooding to Harris County. The storm caused over 100 fatalities and resulted in approximately $125 billion in damages, making it one of the costliest natural disasters in U.S. history. (en.wikipedia.org)

2016: In April, the Tax Day Floods occurred, leading to extensive flooding in northern Harris County. The event resulted in significant property damage and several fatalities. (hcfcd.org)

2008: In September, Hurricane Ike struck Galveston Island, causing storm surges that flooded approximately 2,500 structures in Harris County. The storm also brought rainfall that led to flooding in an additional 1,200 structures. (hcfcd.org)

Why this Matters

The history of severe weather events in Harris County underscores the critical need for proactive mitigation strategies. The region's flat topography, high urbanization, and proximity to the Gulf Coast make it particularly susceptible to flooding and tropical cyclones. Implementing effective mitigation measures is essential to reduce the impact of future disasters and enhance community resilience. (houstonchronicle.com)

Home Vulnerabilities: Recommended Actions & Costs

This residence in Houston, Texas, is situated in an area with a high flood risk, a significant wind risk, and a moderate drought risk. Flooding poses the most immediate threat, necessitating measures such as elevating utilities, installing flood barriers, and enhancing drainage systems. High winds, common during severe storms, require reinforcing the structure with impact-resistant windows, securing the roof, and maintaining trees to prevent damage. Drought conditions, though less frequent, can lead to water shortages; implementing water-efficient landscaping, installing smart irrigation systems, and capturing rainwater are effective strategies. Addressing these hazards in order of priority will enhance the home's resilience, reduce potential damage, and may qualify homeowners for insurance discounts and rebates that offset initial costs.

Flood Risk

Houston's flat topography and extensive bayou system make it highly susceptible to flooding, especially during heavy rainfall and hurricanes. The city's infrastructure, including the Addicks and Barker reservoirs, plays a crucial role in flood control. Homeowners should proactively implement flood mitigation measures to protect their properties.

| Risk Level | Recommended Upgrade | Why It Helps | Est. Cost (Project) | Est. Cost per Unit | Product Link |

|---|---|---|---|---|---|

| 10/10 | Elevate HVAC Units | Raising HVAC systems above expected flood levels prevents water damage and ensures functionality during floods. | $5,000 | $5,000 | Carrier |

| 10/10 | Install Flood Barriers | Deployable barriers around entry points prevent water intrusion during flood events. | $2,000 | $200 | Quick Dam |

| 10/10 | Upgrade to Flood-Resistant Materials | Using materials like concrete or pressure-treated wood in flood-prone areas reduces water damage. | $10,000 | $10,000 | BASF |

| 10/10 | Implement Sump Pumps | Sump pumps remove accumulated water from basements and crawlspaces, reducing flood risk. | $1,500 | $1,500 | Zoeller |

| 10/10 | Maintain Gutters and Downspouts | Regular cleaning ensures proper water flow, preventing overflow and potential flooding. | $300 | $300 | Gutter Helmet |

Note: All prices are estimated on available unit prices as of report date. Quantities must be confirmed via a XHome Survey virtual inspection to calculate accurate project labor and material cost.

Wind Risk

Houston's coastal location exposes it to high winds from hurricanes and severe storms. Strengthening the home's structure and securing loose items can mitigate wind damage.

| Risk Level | Recommended Upgrade | Why It Helps | Est. Cost (Project) | Est. Cost per Unit | Product Link |

|---|---|---|---|---|---|

| 9/10 | Install Impact-Resistant Windows | These windows withstand high winds and debris, reducing the risk of breakage. | $15,000 | $500 | Pella |

| 9/10 | Secure Roof with Hurricane Straps | Reinforcing the roof with straps prevents uplift during high winds. | $2,000 | $2,000 | Simpson Strong-Tie |

| 9/10 | Maintain Trees and Shrubs | Proper pruning reduces wind resistance and the risk of falling branches. | $500 | $500 | Arbor Day Foundation |

| 9/10 | Install Garage Door Reinforcements | Strengthening garage doors prevents them from collapsing under wind pressure. | $1,000 | $1,000 | FEMA |

| 9/10 | Use Shatterproof Window Films | Applying films to existing windows enhances their resistance to windborne debris. | $1,200 | $1,200 | 3M |

Note: All prices are estimated on available unit prices as of report date. Quantities must be confirmed via a XHome Survey virtual inspection to calculate accurate project labor and material cost.

Drought Risk

While Houston experiences occasional droughts, the risk is moderate compared to other hazards. Implementing water conservation measures can help mitigate the impact of water shortages.

| Risk Level | Recommended Upgrade | Why It Helps | Est. Cost (Project) | Est. Cost per Unit | Product Link |

|---|---|---|---|---|---|

| 4/10 | Install Smart Irrigation Systems | These systems adjust watering schedules based on weather conditions, conserving water. | $1,500 | $1,500 | Rachio |

| 4/10 | Use Native, Drought-Tolerant Plants | Native plants require less water and are more resilient during dry periods. | $500 | $500 | Native American Seed |

| 4/10 | Implement Rainwater Harvesting | Collecting rainwater for irrigation reduces dependence on municipal water systems. | $2,000 | $2,000 | RainHarvest Systems |

| 4/10 | Apply Mulch to Landscaping | Mulch retains soil moisture, reducing the need for frequent watering. | $300 | $300 | The Home Depot |

| 4/10 | Install Drip Irrigation Systems | Drip systems deliver water directly to plant roots, minimizing evaporation. | $800 | $800 | DripWorks |

Note: All prices are estimated on available unit prices as of report date. Quantities must be confirmed via a XHome Survey virtual inspection to calculate accurate project labor and material cost.

Insurance Discounts & Savings

Insurance premium costs are escalating due to more frequent and costly disasters. Insurance companies are leaving markets. Property owners either can’t get covered, are facing huge premium increases, and subsequent loss of insurance which leads to home loss and foreclosures.

Mitigating specific risks through home upgrades may make you eligible for premium discounts through your insurance carrier.

In Houston, Texas, certain hazards have been identified with risk scores of 9 or higher, indicating a significant potential for damage. Implementing specific upgrades can not only enhance your home's resilience but also make you eligible for insurance premium discounts.

| Hazard | Upgrade Option | Program | Requirement | Discount % | Annual Savings |

|---|---|---|---|---|---|

| Flood | Elevation | NFIP | Elevate home above Base Flood Elevation (BFE) | Up to 60% | Varies |

| Wind | Impact-Resistant Roofing | TWIA | Install impact-resistant roofing materials | 19% to 33% | Varies |

| Wind | Wind-Resistant Features | TWIA | Reinforce garage doors, install storm shutters | Varies | Varies |

| Wind | FORTIFIED Home Designation | TWIA | Obtain FORTIFIED designation for wind resistance | Varies | Varies |

| Wind | Windstorm Inspection | TWIA | Pass windstorm inspection for coverage eligibility | Varies | Varies |

| Device-Based | Home Security System | Various Insurers | Install monitored home security system | 5% to 15% | Varies |

Note: Annual savings are based on average insurance discounts, energy/water reductions available in your area, avoidable losses are estimated on your community (actual results may vary).

Note: Submitting documentation and proof is critical for both insurance and public funding. Attach forms when submitting evidence of qualified upgrades.

Funding Sources – Resources for Paying for Remediation

Available resources may assist you with the cost of upgrades listed and recommended in this report. Some sources are tied to hazards, while others are general-purpose.

| Hazard | Program | Type | Est. Value | Notes |

|---|---|---|---|---|

| Flood Risk | Flood Mitigation Assistance (FMA) Grant Program | Federal Grant | Varies | Provides funds for projects to reduce or eliminate the risk of flood damage to buildings insured under the National Flood Insurance Program (NFIP). |

| Flood Risk | Flood Infrastructure Fund (FIF) | State Loan/Grant | Varies | Offers financial assistance for flood control, flood mitigation, and drainage projects in Texas. |

| Flood Risk | Harris County CDBG-MIT Program | Local Grant | Varies | Supports flood mitigation projects in Harris County, including drainage improvements and infrastructure enhancements. |

| Wind Risk | Building Resilient Infrastructure and Communities (BRIC) Program | Federal Grant | Varies | Supports hazard mitigation projects that reduce disaster risk in communities, including wind-resistant infrastructure. |

| Wind Risk | Texas Windstorm Insurance Association (TWIA) | State Insurance Program | Varies | Provides windstorm and hail insurance coverage for eligible properties in designated catastrophe areas. |

Please note that funding values and program details are subject to change. It's advisable to consult the respective program websites or contact program administrators for the most current information.

Savings Summary (Annual Estimates)

Upfront investments in completed resilience upgrades pay off through reduced damage risk, lower premiums, utility savings, and rebate reimbursements.

| Savings Category | Sub-Category | 1-Year | 3-Year | 5-Year |

|---|---|---|---|---|

| Insurance Discounts | ||||

| Floodproofing (elevating structure, installing barriers) | $300–$500 | $900–$1,500 | $1,500–$2,500 | |

| Windstorm mitigation (roof reinforcement, impact-resistant windows) | $200–$400 | $600–$1,200 | $1,000–$2,000 | |

| Subtotal – Insurance Discounts | $500–$900 | $1,500–$2,700 | $2,500–$4,500 | |

| Direct Costs Avoided | ||||

| Flood damage reduction | $5,000 | $15,000 | $25,000 | |

| Windstorm damage reduction | $3,000 | $9,000 | $15,000 | |

| Subtotal – Direct Costs | $8,000 | $24,000 | $40,000 | |

| Indirect Costs Avoided | ||||

| Smoke damage, evacuation costs, displacement | $500 | $1,500 | $2,500 | |

| Heat-related health risks (cooling, medical, productivity) | $250 | $750 | $1,500 | |

| Subtotal – Indirect Costs | $750 | $2,250 | $4,000 | |

| Utility Savings | ||||

| Cool roof, attic venting, HVAC upgrades | $150 | $450 | $800 | |

| Smart irrigation & xeriscaping | $100 | $300 | $600 | |

| Subtotal – Utility Savings | $250 | $750 | $1,400 | |

| Rebates & Grants | ||||

| Turf replacement, rainwater capture rebates | $500 | $1,500 | $2,500 | |

| CEA seismic retrofit grant (if eligible) | $1,000 | $3,000 | $3,000 | |

| Subtotal – Rebates & Grants | $1,500 | $4,500 | $5,500 | |

| Total Potential Annual Savings | $15,000–$16,400 | $32,500–$36,200 | $53,400–$55,400 |

Annual savings are based on average insurance discounts, energy/water reductions, and estimated avoided losses (actual results may vary). Having documentation and proof is critical for both insurance and public funding; attach forms when submitting evidence of upgrades. Before major work, confirm eligibility for rebates or grants—some programs are first-come, first-served and may have deadlines.

Regulations and Policies

Important environmental, insurance, and building code regulations that apply to your region are highlighted in the chart below. State and local requirements that may affect your ability to complete upgrades, qualify for funding, or reduce insurance costs are included. Some programs are mandatory for insurance eligibility, while others are voluntary but provide financial or permitting advantages.

| Hazard Type | Regulation / Policy Name | Program Type | Enforcement | |

|---|---|---|---|---|

| Flood Risk | National Flood Insurance Program (NFIP) | Federal Program | Mandatory for properties in flood-prone areas | |

| Flood Risk | Harris County Stormwater Quality (SWQ) Permit | Local Permit | Required for new developments and significant redevelopments | |

| Wind Risk | Texas Windstorm Insurance Association (TWIA) Building Code | State Building Code | Mandatory for windstorm insurance eligibility | |

| Wind Risk | Texas Windstorm Insurance Association (TWIA) Windstorm Certificate of Compliance (WPI-8) | State Certification | Required for windstorm insurance eligibility | |

| Stormwater Management | Municipal Separate Storm Sewer System (MS4) Program | Local Program | Enforces stormwater management and pollution prevention | |

| Stormwater Management | Stormwater Pollution Prevention Plan (SWPPP) | Regulatory Requirement | Required for construction sites discharging stormwater | (houstonpermittingcenter.org) |

Please note that while some programs are mandatory for insurance eligibility, others are voluntary but provide financial or permitting advantages. It's advisable to consult with local authorities or a professional to ensure compliance with all applicable regulations.

Links and Resources

Below are local and federal agencies, organizations, and programs that support disaster mitigation and resilience upgrades in your region.

| Resource/Agency | Website / Contact |

|---|---|

| City of Houston's Disaster Recovery Mitigation Program | https://houstontx.gov/hcdrecovery/dr-mit/ |

| Harris County Flood Control District | https://www.hcfcd.org/ |

| Texas General Land Office (GLO) Disaster Recovery | https://www.glo.texas.gov/disaster-recovery |

| Community Development Block Grant-Disaster Recovery (CDBG-DR) Program | https://www.hud.gov/programoffices/commplanning/cdbg/dr |

| AlertHouston Public Alert System | https://www.houstontx.gov/alerthouston/ |

| Channel Industries Mutual Aid (CIMA) | https://www.cimatexas.org/ |

| Ike Dike Project | https://www.tamug.edu/ikedike/ |

| Emergency Management Assistance Compact (EMAC) | https://emacweb.org/ |

Community Resources

Here are local resources and programs available to assist with flood and wind hazards in Houston, Texas:

| Resource/Agency | Description | Website / Contact Info |

|---|---|---|

| AlertHouston | The City of Houston's official emergency alert system, providing real-time notifications about severe weather, traffic disruptions, and other emergencies. Residents can register to receive alerts via text, email, or voice call. | AlertHouston Registration |

| Harris County Flood Control District (HCFCD) | A government agency dedicated to reducing the effects of flooding in Harris County. HCFCD offers resources, floodplain management assistance, and information on flood mitigation projects. | HCFCD Website |

| Houston Public Works - Floodplain Management Office | Provides comprehensive flood information, including flood zone determinations, elevation certificates, and guidance on floodproofing and mitigation techniques. | Floodplain Management Office |

| Resilient Houston | A city initiative aimed at enhancing Houston's resilience to natural disasters, including flooding and hurricanes, through strategic planning and community engagement. | Resilient Houston Plan |

| ReadyHarris Alerts | A service that allows residents to opt-in to receive notifications about events that may affect their home, workplace, or school, including severe weather events and hazardous material emergencies. | ReadyHarris Alerts |

| Community Emergency Response Team (CERT) | Offers training to residents to support neighbors and strengthen local capacity in disaster response and recovery. | CERT Program |

These resources are designed to help residents prepare for and respond to flood and wind hazards in the Houston area.

Annual Subscription

Like the weather, risk is constantly changing. A Future Proof subscription levels the playing field between homeowners and insurance carriers by providing annual, property-specific risk reports. Your subscription includes one property address report and renews annually.

Powered by IBM’s supercomputers—processing global data from academic institutions and agencies taking over two weeks—our forward-looking models deliver unmatched risk analysis. Just because your property is in the clear today means it will be tomorrow.. your insurance carrier knows, good idea you should too.

Your subscription keeps you ahead of shifting threats with annual updates and new features like our coming extreme weather alert system, enhancing protection and prevention for greater personal safety.

As disaster footprints expand and government support declines, staying in-formed is critical. Future Proof helps you protect your home, your family, and your future—because chance favors the prepared mind.

Muti-property Subscriptions

Own vacation properties, duplexes, or apartment buildings? Future Proof offers discounted multi-property address packages—each including added benefits like tailored construction enhancements and strategies to reduce costs. Packages renew on every property in your catalog annually.

Methodology and Data Sources

Future Proof’s methodology is simple: combine top insurance risk models with imaging from Apple, Google, EagleView, and our XHome Survey™ app to digitally deconstruct each property with AI.

We identify vulnerabilities, apply code-compliant engineering, and use climate-resilient materials to virtually remodel homes for durability. Leveraging 500B+ data points from IBM, NOAA, FEMA, and The Weather Co., we assess risks against America’s aging housing stock—averaging 60 years old.

With computer vision, we detect flaws, apply best practices, and deliver affordable, effective plans—then connect you with suppliers, contractors, and financing. We build a detailed property dossier and generate innovative AI-driven solutions no other service can match—helping protect families and addressing the growing insurance crisis.

Terms in our Universe

Remediation & Risk

In insurance and mortgage underwriting, remediation means upgrades that reduce a property’s vulnerability to hazards like fire, flood, or extreme weather. These improvements lower risk scores, qualify homeowners for premium discounts, grants, tax credits, and better mortgage terms. For lenders, remediation protects collateral value and reduces claim losses.

Insurance Underwriting

Insurance operates like a casino—betting your home won’t be hit. When too many properties in an area share high risk, insurers raise premiums, restrict coverage, or exit altogether. Future Proof™ changes this dynamic by combining precise risk identification on your property with engineered remediation. We help harden structures, reduce claims, and keep insurance viable for both owners and carriers.

Discounts & Incentives

Insurers use risk tables that factor in claims history, community data, and construction details such as materials, stories, elevation, and exposure to wildfire, flood, or storms. Future Proof analysis employs this data.

Programs & Codes

State and local programs often fund resilience upgrades—like fortified roofs, impact-resistant windows, drainage improvements, or wildfire defensible space—through grants, tax credits, or low-interest loans. At the same time, modern building codes increasingly require higher standards, even for retrofits. Future Proof’s XHome Survey™ reports align with 2024 International Building and Fire Codes and connect you with local departments to simplify compliance.

About Future Proof

"At Future Proof, we’re tackling the extreme weather-driven insurance crisis head-on”

"At Future Proof, we’re tackling the extreme weather-driven insurance crisis head-on”– Ben Gilliland, Chairman/Founder

Our roots go back to 2019, when The Paulele Hale Association a Hawai’i non-profit built the first 'Future Proof' home—designed to withstand wildfire heat up to 1200°F, 150 mph hurricane winds, earthquakes, and drought with autonomous water generation. Their insurance provider acknowledged its engineered resilience with a 15% discount, substantiating mitigation saves money.

What we do

The Future Proof Extreme Weather Community Risk and Mitigation Report, is generated by the Visionary AI Engine™ using the Magic Window® app.

With IBM Climate Intelligence models and Visionary AI’s deep learning knowledge base of construction we show how extreme weather may impact your property over the next 25+ years.

Magic Window is designed to inform property owners, assess community-level risk and generate disaster risk estimates and their potential impact, make remodeling recommendations, estimate savings, and provide resources to help reduce your property’s vulnerabilities.

The XHome Survey™ app (coming soon) creates a digital 3D twin of your property to inspect, then applies advanced engineering to deliver detailed remediation plans, budgets, financing options, with links to suppliers and contractors.

Future Proof’s holistic approach demonstrates how targeted remodeling improves safety, increases value, lowers insurance costs, and connects you with local resources.

Why we do it

Future Proof Intelligence PBC is a for profit, public benefit corporation with a legally mandated mission we actively pursue and report on to our shareholders, customers and the State of Delaware.

Have questions? For more about Future Proof, our AI Platform, your property and our mission to help protect it ask our FutureView agent “Malia”- visit futureproof.org